-

Overview

Online Banking

(Looking to login?)

Experience e-Teller, our free online banking system for all of your Spirit of Alaska Federal Credit Union accounts. It’s easy to set up, and provides you with a user-friendly experience alongside leading security technology.

From e-Teller you can do everything you need to manage your finances and account balances, including automated and manual money transfers, payments to your loans, trying Bill Pay, exporting accounts to Quicken or Microsoft Money, order checks, and more.

Through e-Teller you can also access Home Connect through the Statement button, which gives you access to account statements, loan bills, tax forms, receipts, and much more. It’s also simple to communicate securely with our operations department about your accounts and personal information though e-Teller messages.

Tools to manage your account online

- Access all account features online

- Securely communicate with Spirit of Alaska representatives

- Financial documents stored in Home Connect with 256-bit encryption

- Make Spirit of Alaska payments online

- Transfers, check orders, and more!

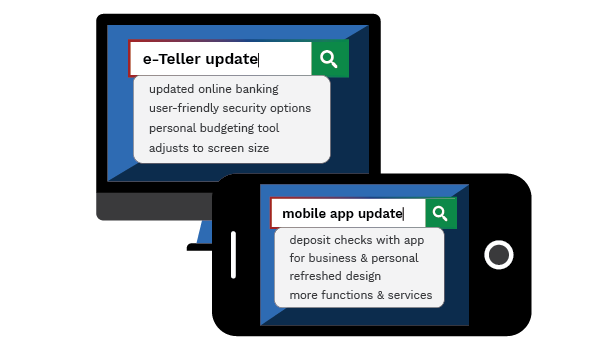

New e-Teller Arriving November 2019

Been looking for an update?

The search is over! Spirit of Alaska announces major updates to our online banking system and mobile app. Our online banking application and mobile app will be completely refreshed, with several exciting new options and functionality to make accessing your accounts online easier.

Scheduled for Late 2019/Early 2020

Scheduled for Late 2019/Early 2020"Thank you for all your services. I enjoy being a member of this Credit Union, and love your online banking website and everything it offers."

- P.S.Security & Encryption

e-Teller deploys full 256-bit security encryption and dual authentication. There are added layers of security that look for unauthorized or uncharacteristic behavior. You can also add your own additional layers of safety by adding unique questions to protect access to your account.

Home Connect

Available through your Statements button in e-Teller, Home Connect is safer than sensitive documents sitting in your mailbox, reducing chances of identity theft. Receive statements and notices sooner than by mail, and view, print, download and access current and past documents.

Paper copies are available for a small fee. See our Pricing Guide.

With Home Connect, you can access:

- Transaction documents: deposited checks, paid checks, receipts.

- Loan documents for mortgage, credit cards, and consumer loans.

- Member agreements.

- Account Statements and notices.

- IRS 1099/1098 statements.

Bill Pay

Access our Bill Pay service through e-Teller in the Payments area. Read More…

Mobile Banking

Access your accounts on your phone or tablet with our convenient phone app for both Apple and Android systems. Keep in mind that there are differences in the information and transaction types available on the desktop version of e-Teller versus the mobile app. Read More…

e-Teller Training Videos

Check out these helpful videos that walks through some of the most commonly used areas of our e-Teller system. The videos were created before our website update on May of 2017, but the functionality of e-Teller remains the same.

Using e-Teller

Budgeting with e-Teller

-

FAQ

Frequently Asked Questions

-

How long does it take to enroll in e-Teller?

Less than five minutes.

-

Is e-Teller available all the time?

e-Teller is available for 24 hours a day, seven days a week, 365 days a year. We occasionally have scheduled maintenance periods, which we will notify you about.

e-Teller may also be unavailable due to unscheduled maintenance or other technical problems, but we try our best to make these interruptions as infrequent as possible.

-

What software do I need for e-Teller?

In order to provide you with the maximum level of security, we require that you use a browser that supports 256-bit encryption. Browsers that fulfill this requirement include: Internet Explorer (IE) 8 and higher, Firefox 14 and higher, Safari 5, Chrome 20 and higher.

-

I am "Locked Out" of e-Teller. What do I do?

For safety and security, after three consecutive unsuccessful log-in attempts, you will be locked out of e-Teller until a Spirit of Alaska representative resets your bad password count. For security reasons, we require that you contact a Member Service Representative during regular business hours at (907) 459-5900 or (800) 478-1949.

-

How can I tell if my browser supports 256-bit encryption?

If you are using Microsoft Internet Explorer, do the following:

- Pull down your browser’s Help menu and select About Internet Explorer. A pop-up window will appear with information on Internet Explorer.

- Look for a line that begins with the words “Cipher Strength”. If the cipher strength is anything less than 256-bit, you must upgrade your browser in order to use e-Teller. You can go directly to Microsoft’s website and obtain the upgrade by clicking on the words “Upgrade Information”.

-

Is e-Teller just for personal accounts, or can businesses also use e-Teller?

e-Teller is a great option for both individuals and businesses. However, you should note that due to banking regulations, you cannot create a single enrollment that includes both business accounts (for which tax is reported under a Tax ID Number) and personal accounts (for which tax is reported under your Social Security Number).

We do have Online Banking for Business, but you will have two logins if you have both personal and business accounts.

-

How do I get a Sign-On ID and password for e-Teller?

In order to get a Sign-On ID and password for e-Teller, you need to enroll your account(s) using our online enrollment process.

- Click Login next to the menu button, and then Enroll in Online Banking. After transferring to our online banking site, you will see buttons for Enroll a Person and Enroll a Business. Click on the button that applies to you. This will take you to the appropriate online enrollment form.

- Complete the enrollment form and submit it.

- If you are enrolling as a person and the information you provided agrees with our system information, you will be given immediate access.

- If you are enrolling as a business, we will verify your information and send you a temporary password within 24 hours, via the email you provided. When you log in for the first time, the e-Teller service will then require your to change that password.

-

What are the requirements for my Sign-On ID and password?

You can choose your own Sign-On ID and password, within the following rules:

- Passwords can contain a mixture of alphabetic, numeric and other symbol characters, and must be between eight (8) and fifteen (15) characters long with a minimum of 2 numeric characters.

- The following symbolic characters are allowed: ! + & @ – . , : # $ % ~ ` ‘ ( ) [ ].

- Passwords are case sensitive.

-

What do I do if I forget my password?

- Simply choose the “Forgot Your Password?” link in our login area on the website. This will bring you to a screen where you will need to provide your Sign-On ID and your email address.

- Answer the security question you chose when you first enrolled in e-Teller.

- If you answer your security question correctly, your password will be emailed to the email address we have on file. You will have only 3 minutes to access your email and enter the one-time password in e-Teller.

- e-Teller will immediately prompt you to change your password after you login with the temporary password.

- As a security measure, you cannot change your password over the phone.

-

What do I do if I don’t remember my Sign-On ID?

For Personal Accounts: If you forgot your Sign-On ID, you can visit one of our branches and speak to a Member Service Representative (MSR). The MSR can assist you with this problem.

For Business Accounts: If you forgot your Sign-On ID for your business account, and you are the primary administrator, you can visit one of our branches. If you are not the primary administrator, you must call the System Administrator for your company.

As a security measure, we will not provide Sign-On IDs over the phone for either personal or business accounts.

-

What account information can I see online with e-Teller?

e-Teller shows you a list of your accounts, summary information about each account, a transaction register, lists of pending bill payments and transfers, and lists of your payees. Initially, e-Teller will display up to 90 days of history for your accounts.

As you use e-Teller, your transaction history will accumulate. e-Teller reports allow you to see summaries and detailed information about all of your accounts. You can assign transactions to categories that you define, and then report on transactions using those categories. Reports allow you to see at least 2 years of activity.

-

Why am I being asked for additional information when I log in to e-Teller from a different computer than I usually use?

This standard security feature is an added layer of protection. It will prompt you to answer some questions and provide contact information which will be used to verify your identify in e-Teller sessions. If unusual or uncharacteristic behavior occurs during an the e-Teller session, the user will be prompted to verify the account holder’s identity.

On occasion the account holder may receive an automated phone call and be prompted to enter the code that will appear on their computer screen in order to make sure no fraudulent transaction has occurred. Providing up-to-date information to the Credit Union will ensure a trouble-free e-Teller session.

-

I just opened a new account, but I don't see the account on my e-Teller.

When you request that an account be added, it will usually appear in your Accounts summary the next time you sign on.

If the account does not appear, send a secure message through e-Teller to the Customer Service desk or call us during regular business hours at (907) 459-5900 or (800) 478-1949.

-

The information in my register does not appear to be up-to-date.

e-Teller operates in real-time. Transactions are updated immediately. Debit card transactions may appear as pending. If you believe that an item has cleared but does not appear in your register, send a secure message through e-Teller to the Customer Service desk. The matter will be researched and you will be notified within 24 hours. You can also call us at (907) 459-5900 or (800) 478-1949 during regular business hours.

-

I have scheduled a transfer and it did not go through—what should I do?

If your transfer has not been posted to your account, send a secure message through e-Teller to the Customer Service desk. Please specify the transaction information and we will research the issue and get back to you within 24 hours. You can also call us at (907) 459-5900 or (800) 478-1949 during regular business hours.

-

I can view other areas of e-Teller, but I can't get into my accounts through e-Teller. What's wrong?

If you are unable to access secured areas within your accounts in e-Teller, it may be because of your browser and Internet Service Provider. Your browser and Internet Service Provider must support secured sites.

Another reason that you might not be able to access e-Teller is that cookies may not be enabled. In order to enter the secure encrypted site, you must be accepting cookies. To enable cookies, please refer to the Help function of the browser you are using.

-

Can I use my browser's Back and Forward buttons to go from one e-Teller page to another?

In general, you should never use your browser’s Back or Forward buttons to go from one e-Teller page to another. If you are doing a transaction—such as paying a bill, or transferring money—use the buttons at the bottom of the page. Use the buttons at the top of a page to perform a function related to that page, such as Add Payee or List Payees. If you are viewing information and want to go to another page, use the links on the left-hand side of each page.

-

What are my options for transferring between accounts?

You may transfer funds between any personal account where you are the primary or joint owner, plus you can also transfer to another Spirit of Alaska personal account where you are not a primary or joint owner (see below FAQ). You cannot transfer this way to a business account.

Follow the prompts to complete the transaction.

-

I have both business accounts and personal accounts; can I transfer between them?

If your business has its own tax ID number (TIN), then you cannot transfer between your business and personal accounts. Banking regulations prevent the Credit Union from allowing this type of transaction. You can use Bill Pay to solve this problem, which is available through personal e-Teller. As a person, you can pay your business; and your business can pay you as a person.

-

How do I transfer to an account I am not a signer on?

Click on the Transfers tab at the top of the page. Click on “Transfer to an account that is not yours” from the menu on the left.

You must setup the recipient of an account that is not yours, which is simple to do using the “Setup an account that is not yours” link on the page.

Then, complete the required information and click Submit. Be sure to call us at (907) 459-5900 or (800) 478-1949 if you need further assistance.

-

How do I view checks, statements, notices, or agreements?

Click on Accounts at the top of the page; Click on Statements from the menu to the left; this takes you to our Home Connect page where all of these items can be accessed. Only the primary account holder has access to e-Statements. For security purposes you MUST choose ‘Logoff’ when you are done viewing your statements, notices, bills and tax forms.

-

How do I order checks?

Click on Account Services at the top of the page; Click on Requests from the menu to the left; click on the Check link and complete the form and submit. You will receive your checks in 7-10 days in the mail.

-

How long does it take to enroll in e-Teller?

Home Online Banking