-

Overview

Online Banking for Business

Do more for your business with the Business e-Teller option from Spirit of Alaska Federal Credit Union. Accessing your business or non-profit’s bank accounts should not be time-consuming. When you have a business account with Spirit of Alaska, you get all the benefits of a personal e-Teller account, plus built-in features made exclusively for businesses, such as user management and cash/asset management.

Secure Online Banking for Businesses and non-profits

- Designate authorized users

- Monitor assets and business finances in a snap

- Make loan payments for Spirit of Alaska business loans

- Import data to accounting software for easier business taxes

- 256-bit security and dual encryption

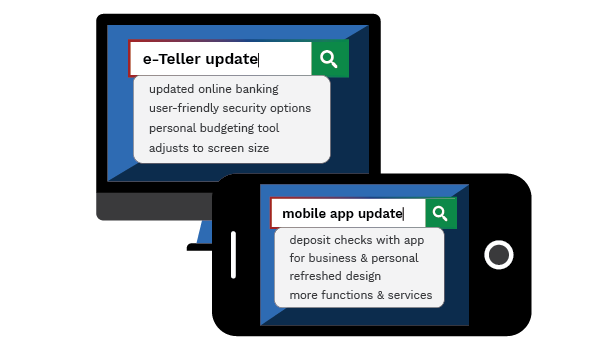

New e-Teller Arriving November 2019

Been looking for an update?

The search is over! Spirit of Alaska announces major updates to our online banking system and mobile app. Our online banking application and mobile app will be completely refreshed, with several exciting new options and functionality to make accessing your accounts online easier.

Available Late 2019/Early 2020

Available Late 2019/Early 2020"We've been with them for 15 years and really like them. In a credit union, 100% of our money stays here in the community and cycles throughout the Fairbanks area. Their online system is simple to use..."

- S.A.Additional Features

Create and download export files for Quickens to manage your business. Use Bill Pay to pay your bills, make loan payments to your Spirit of Alaska loan and manage finances with our easy online register. Through e-Teller you can access Home Connect which gives you access to your business documents with us, such as statements, loan bills, tax forms, receipts and more.

e-Teller uses full 256-bit security encryption with dual authentication running in the background and added layers of protection, such as security questions to limit login attempts, so you do not have to worry about someone accessing your business’s bank accounts.

-

FAQ

Frequently Asked Questions

-

How do I get a Sign-On ID and password for business e-Teller?

To get a Sign-On ID and password for e-Teller, you need to enroll your account(s) using our online enrollment process. To enroll, go to www.spiritofak.com and do the following:

- Click on “Login” located on the upper right of the website.

- Click on “Enroll in Online Banking”. You will be taken out to our online banking application. Click the button for Enroll a Business.

- This will take you to the appropriate online enrollment form.

- Complete the enrollment form and submit it.

- Spirit of Alaska will verify your information and send you a temporary password within 24 hours, via the email you provided. When you log in for the first time, the e-Teller service will require that you change your password.

-

Can I choose my own Sign-On ID and password?

You can choose your own Sign-On ID. For business accounts, Spirit of Alaska will establish a password at first. When you log in for the first time, the e-Teller service will require that you change that password.

Passwords should contain a mixture of alphabetic and numeric characters, and must be between eight (8) and fifteen (13) characters long. At least one character must be neither a letter or a number, but a character from the following: ! + & @ – . , : # $ % ~ ` ‘ ( ) [ ]. Passwords are case sensitive.

-

What do I do if I forget my password?

This is the same for Business accounts and Personal accounts. Simply choose the “Forgot Your Password?” link to the right of the Password blank. This will bring you to a screen where you will need to provide your Sign-On ID and your email address. Then answer the security question you chose when you first enrolled into e-Teller. If you answer your security question correctly, your password will be emailed to the email address we have on file.

-

What do I do if I don’t remember my Sign-On ID?

If you forget your Sign-On ID and you are the primary administrator, you can visit one of our branches and speak to a Member Service Representative (MSR).

If you are not the primary administrator, you must call the System Administrator for your company.

-

How do I add an administrator to my business e-Teller?

Click on the Administrator tab and click on the add new user button

- Fill out the new user information

- Assign a username and password

- Assign their user rights as an admin (manage company, manage accounts, manage users, etc.)

-

How do I disable an admin user for business e-Teller?

Click on the Administrator tab, check the box of the user you want to disable and click the disable button.

-

I have multiple accounts, can I transfer between them?

You may transfer funds between any account where you are the primary or joint owner for the business accounts. At this time cross-account transfers are not permissible for business e-teller or if you are a primary or joint owner for a personal account.

Click the Transfer Funds tab from the menu bar and follow the prompts. You must click the Confirm tab at the conclusion of your transactions to authorize the transfer.

-

I have both business accounts and personal accounts; can I transfer between them?

If your business has its own tax ID number (TIN), then you cannot transfer between your business and personal accounts. Banking regulations prevent the Credit Union from allowing this type of transaction. As a person, you can pay your business; and your business can pay you as a person.

- If you a primary or joint owner for the business and personal accounts, you can set up a reoccurring transfer or you can send a secure message through business e-teller to perform the transfer.

- The transfer can be made by calling the Call Center during business hours (907) 459-5900 or (800) 478-1949 or visit one of our branches during business hours.

-

How do I download to Excel or Quicken?

From the Account Overview page, click on the account you want to download from. Then, click on the export link located at the top right of the page. Complete the information to generate the export. These are the types of exports that are supported by e-Teller:

- CSV

- Excel

- Money Compatible

- Quicken

-

How do I get a Sign-On ID and password for business e-Teller?

Home Online Banking for Business